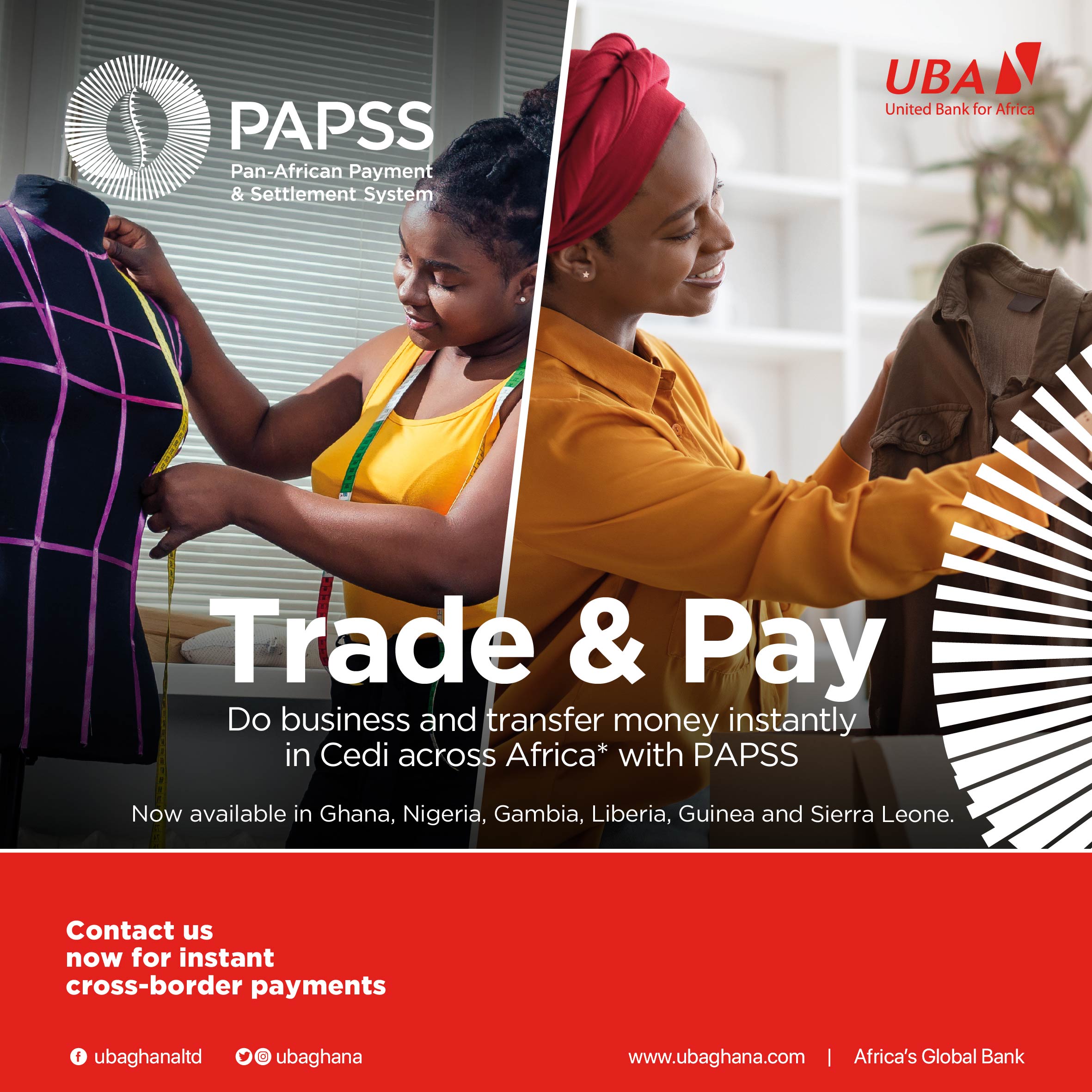

PAPSS: Pan-African Payment Settlement System

PAPSS – the Pan-African Payment and Settlement System – is a cross-border, financial market infrastructure enabling payment transactions across Africa.

Connecting Payments. Accelerating Africa’s Trade

PAPSS addresses the historic challenges of making payments across African borders, adding value through a common African market infrastructure for all stakeholders, from governments, banks and payment providers to corporates, small enterprises and individuals.

Benefits

- Instant/near instant payments of cross-border transactions without the hassle of currency conversion

- Improved working capital through payment certainty and faster transactions

- Access to various payment facilitating options through a growing network of financial intermediaries

Benefits of PAPSS

FAQS

PAPSS, the Pan-African Payment & Settlement System is a centralized financial market infrastructure. It facilitates the payment for and settlement of intra-African trade of goods and services in multiple African currencies.

It is designed to effect instant payments in local currencies and use Central Banks or Commercial banks as settlement agents

Afreximbank (African Export-Import Bank) operates PAPSS as one of its initiatives to support the implementation of the AfCFTA (African Continental Free Trade Agreement) to boost intra-African trade.

PAPSS works through it’s Participants that include commercial banks and payment service providers such as mobile money operators. These Participants offer the PAPSS service to the end customer. For instance, a customer can walk into a bank or use mobile/online banking to initiate a PAPSS transaction. The transaction is initiated in the sender’s local currency and within 120 seconds the beneficiary will receive funds in their local currency. In order to enable instant payments across African borders in local currencies. PAPSS supports three core processes:

Instant payment: eliminates the need to convert local currencies into hard currencies, which took days to convert and send back to the recipient bank. System compliance, legal, and sanctions checks are also instantaneous – payments process takes up to 120 seconds. However, in Nigeria the National Regulator has decided that PAPSS transactions will be T+1 for inflows and outflows.

Pre-funding: before moving debits and credits across participants’ accounts, PAPSS must ensure that funds are available to execute the originator’s transaction due to the speed of instant payments. Thus, pre-funding is required.

Net settlement: instead of settling each bilateral transaction individually, PAPSS performs a multilateral net settlement. This means that PAPSS aggregates all incoming and outgoing transactions between settlement agents and simply settles the net position. This position is further deducted from the settlement account of the debtor and sent to the creditor.

- Instant Payments made in local currencies thereby domesticating intra-African trade payments.

- Compliance, legal and sanctions checks are performed instantly within the system and payments are processed within 120 seconds.

- Settlement is on a Multilateral Net Basis and agreed settlement currencies.

- PAPSS Operates on a 24×7 basis.

- PAPSS charges are less expensive than any current global payment system.

Toggle CoFor PAPSS to operate effectively in a given country or region, it must sign an agreement with the country’s or region’s Central Bank, which can either be a participant or play a supervisory role. Then, the commercial banks in the market integrate with PAPSS, allowing their customers to transact.

Fintechs currently have to link via commercial banks in order to utilize PAPSS.ntent

PAPSS is up and running in Nigeria, Ghana, The Gambia, Liberia, Guinea, and Sierra Leone, Kenya, Djibouti. Zambia, Zimbabwe, Malawi, Tunisia. Comoros, Egypt and Morocco. While negotiations are in progress in other countries. The list of countries will be updated periodically

PAPSS has been designed to support all types of cross-border transactions: low and high value payments, retail, trade, remittance, etc. However, each National or Regional Regulator will decide the type of transactions allowed in its market

- We are on a journey towards a single African market:

- 2018: System development commenced and WAMZ agreed to Pilot with PAPSS.

- 2019: Adoption and endorsement by the African Union Heads of State.

- 2020: The Governing Structure of PAPSS is formed.

- 2021: Operational rollout of PAPSS. Live transactions commence between West African Monetary Zone Central banks.

- January 2022: PAPSS launched for commercial use.

- September 2022: Commencement of customer transactions.

- April 2023: Partnership with the ASEA (African Stock Exchanges Association) to facilitate and promote a more efficient payment and settlement of transactions of securities across borders to improve the overall landscape of securities markets in Africa.

- June 2023: Introduction of the Commercial bank settlement model and partnership with 5 African Group banks to roll out PAPSS throughout their extensive subsidiary network on the continent.

The Central Banks set the exchange rate. The system allows central banks to set rates on a bilateral basis or against a nominated currency such as the USD or Euro. The PAPSS system at the level of the Central Bank calculates the NET Settlement position of every Bank.